Fixed income experience you can count on

When investing on behalf of an organization, qualities such as security, safety, and income stability are paramount. We

offer our clients access to the broadest selection of principal protected fixed-income investments. Through the backing of

Canada’s largest and most innovative bond desk, we are able to provide top rates on new and secondary market issues,

and develop new structures of notes that allow us to take advantage of current market trends to produce an outsized

return. Regardless of the size of your portfolio, your level of investment knowledge, or how conservative your approach,

we can create an bond portfolio to suit your needs.

Diversified bond portfolio

- Government Debt

- GICs

- Rate Linked Notes

- Equity Linked Notes

Investment-grade bond portfolio

- Government Debt

- GICs

- Structured Notes

Government-only bond portfolio

To learn more about structured notes, please visit our structured solutions page

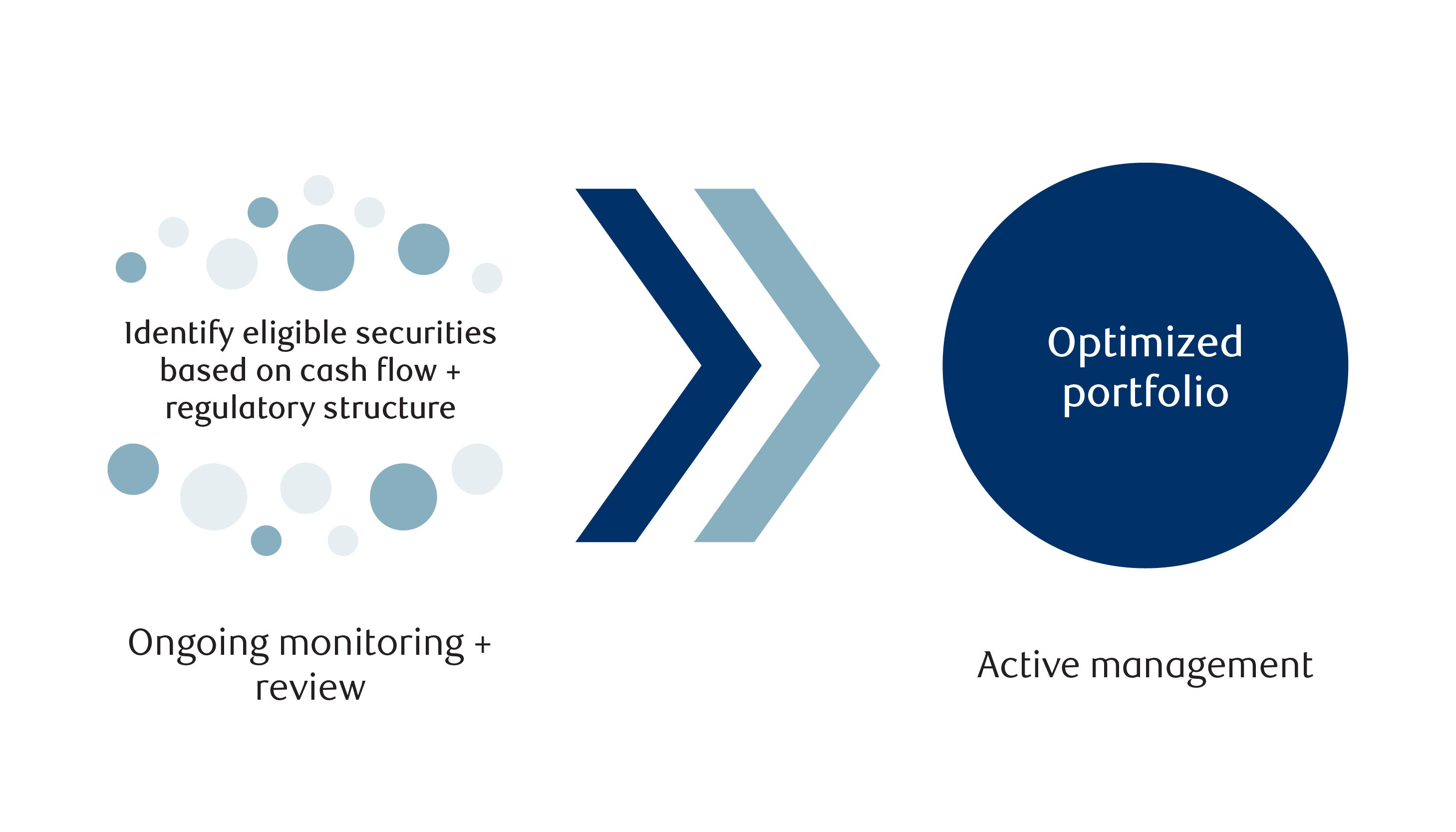

A thoughtful, dynamic cash management program can help boost your organizational effectiveness by maximizing returns on cash reserves— while also preserving capital and maintaining liquidity.

Our tailored, multi-strategy approach is designed to support executives and treasury managers overseeing corporate and institutional cash resources. We help with strategies designed to deliver attractive income and yield, while remaining within your organizations investment policy guidelines.